$5 Gold Coins

Investing in $5 Gold Coins: A Timeless Opportunity for Savvy Investors

In the realm of precious metals investment, $5 gold coins offer a unique blend of historic charm and tangible value, making them a compelling choice for both novice and seasoned investors. These coins, often rich in heritage, represent a bridging of past and present investment wisdom. Their appeal lies not only in their aesthetic beauty but also in their longstanding reputation for reliability and security in asset preservation.

Historical and Market Context of $5 Gold Coins

The $5 gold coin, commonly referred to as the Half Eagle, has a storied past that dates back to the late 18th century. Commissioned by the United States Mint, they were among the first gold coins struck soon after the establishment of the mint in 1792. Their production continued intermittently up to the early 20th century, capturing significant historical moments and shifts in American numismatic art.

The enduring legacy of these coins is a testament to their importance in American history, serving both as a medium of exchange and a symbol of economic resilience. In today's investment landscape, $5 gold coins enjoy renewed interest as investors seek out tangible assets amidst economic uncertainties. Their historical significance enhances their allure, often leading to premiums above their intrinsic metal value.

Key Benefits of Investing in $5 Gold Coins

Investing in $5 gold coins provides several distinct advantages. Firstly, they are highly liquid, meaning they can easily be bought or sold in various markets around the world. This liquidity makes them an ideal choice for those looking to maintain flexibility in their investment portfolio.

Secondly, $5 gold coins contribute significantly to portfolio diversification. Unlike stocks or bonds, these coins are physical assets with intrinsic value that does not rely on the performance of financial markets. This quality makes them a stable hedge against inflation and currency devaluation.

Exploring Product Varieties and Specifics

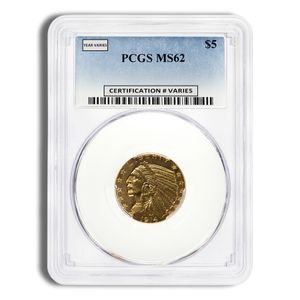

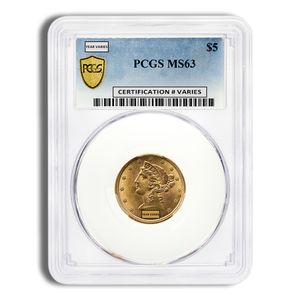

The $5 gold coin category is rich with diversity, featuring various designs and sizes that cater to different investor preferences. Among the most notable are the Liberty Head (Coronet) and Indian Head designs. The Liberty Head Half Eagle, minted from 1839 to 1908, is recognized for its classic portrait of Lady Liberty. The Indian Head, produced from 1908 to 1929, is celebrated for its innovative design featuring a Native American chief adorned with a feathered headdress.

These coins typically contain a net weight of about 0.24187 troy ounces of pure gold, weighing approximately 8.359 grams with a melt purity of 90%. This makes them both a compact and impactful addition to an investor's holdings. They are predominantly struck from 22-karat gold, a standard which attests to their enduring quality.

Renowned Manufacturers and Mints

Networked through the United States Mint, $5 gold coins are synonymous with exceptional quality and craftsmanship. Established in 1792, the U.S. Mint has been a pillar of coin production, renowned for meticulous precision and rigorous standards. Each coin is a product of heritage and trust, ensuring investors receive only items of the utmost quality and authenticity.

Investment Strategies for Maximum Impact

Incorporating $5 gold coins into an investment strategy can vary based on individual goals and timelines. For long-term growth, these coins can be held as a steady store of value, capitalizing on periodic premiums due to scarcity and historical significance. On the other hand, short-term strategies might involve trading in response to market fluctuations to capitalize on rising gold prices.

These coins afford investors the flexibility to balance risk and reward, allowing for an engaging and potentially lucrative investment journey.

Guidance on Purchasing and Storing

When purchasing $5 gold coins, several factors should be considered to ensure sound investment decisions. These include pricing relative to gold spot prices, the coin's mint condition, and potential premiums related to numismatic value.

Equally important is the secure storage of these valuable assets. Options range from home safes to professionally managed vault services that offer insurance and around-the-clock security, thereby safeguarding your investments.

Why Choose Bullion Standard?

When it comes to procuring $5 gold coins, Bullion Standard stands out as a premier choice. Our commitment to offering competitive pricing, combined with an extensive selection of high-quality products, ensures investors can confidently expand their portfolios. Secure transactions and dedicated customer service form the backbone of our business, reflecting our dedication to customer satisfaction and trust.

Take the Next Step with Bullion Standard

Embark on your investment journey by exploring our selection of $5 gold coins today. Whether you're new to investing in precious metals or a seasoned collector, our team at Bullion Standard is ready to assist you with personalized service. Contact us for more information and take the next step towards securing your financial future with timeless, tangible assets.